Tangible asset definition

/What is a Tangible Asset?

A tangible asset is physical property - it can be touched. The term is most commonly associated with fixed assets, such as machinery, vehicles, and buildings. It is not used to describe shorter-term assets, such as inventory, since these items are intended for sale or conversion to cash. Tangible assets comprise the key competitive advantage of some organizations, especially if they use the assets efficiently to produce sales.

Tangible assets are frequently used as collateral for loans, since they tend to have robust, long-term valuations that are valuable to a lender. These assets typically require a significant amount of maintenance to uphold their values and productive capabilities, and likely require insurance protection.

Related AccountingTools Courses

Presentation of Tangible Assets

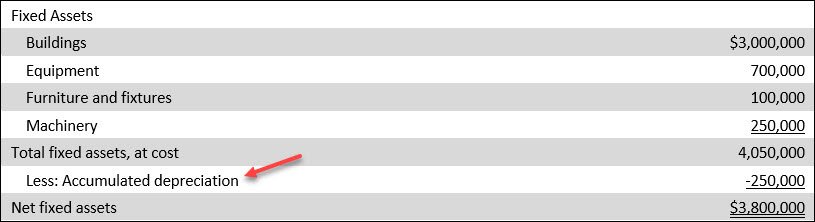

Tangible assets are classified as fixed assets, and so appear in the long-term assets section of a firm’s balance sheet. They may be aggregated into a single summary number, or listed within several asset classifications, such as machinery and equipment or furniture and fixtures. Fixed assets are paired with an accumulated depreciation contra account, which reduces the fixed asset balance by the amount of depreciation charged to-date against all fixed assets on the reporting entity’s books. An example of this presentation appears next.

Intangible Assets

The opposite of a tangible asset is an intangible one, which is not physically present. Examples of intangible assets are copyrights, patents, and operating licenses.